5.1 Concept of Asset Tokenization and Real World Assets (RWA)

Learning Objective: Define asset tokenization and what Real World Assets (RWA) are.

Evolution of Asset Digitization

Asset tokenization is a crucial stage in the asset digitization process. Traditionally, asset ownership was recorded on paper documents or centralized databases. The emergence of blockchain technology allows assets to be represented and traded as digital tokens on decentralized networks.

Definition and Process of Asset Tokenization

Asset tokenization refers to the process of converting tangible or intangible assets of value in the real world (such as real estate, artwork, stocks, bonds, intellectual property, etc.) into digital tokens through blockchain technology. These tokens are issued, recorded, and circulated on the blockchain, representing partial or total ownership of the underlying asset.

Real World Assets (RWA)

RWA refers to assets that exist outside the blockchain and have actual economic value. These assets can be:

- Tangible Assets: Real estate, artwork, collectibles, precious metals (gold, silver), vehicles, infrastructure, etc.

- Intangible Assets: Stocks, bonds, private equity, loans, receivables, intellectual property (patents, copyrights), carbon credits, insurance contracts, etc.

RWA tokenization serves as a key bridge to bring these off-chain assets into the blockchain ecosystem (especially within DeFi), aiming to unlock their liquidity and create new financial opportunities.

5.2 How Asset Tokenization Works

Learning Objective: Understand how real-world assets are mapped to digital tokens via blockchain.

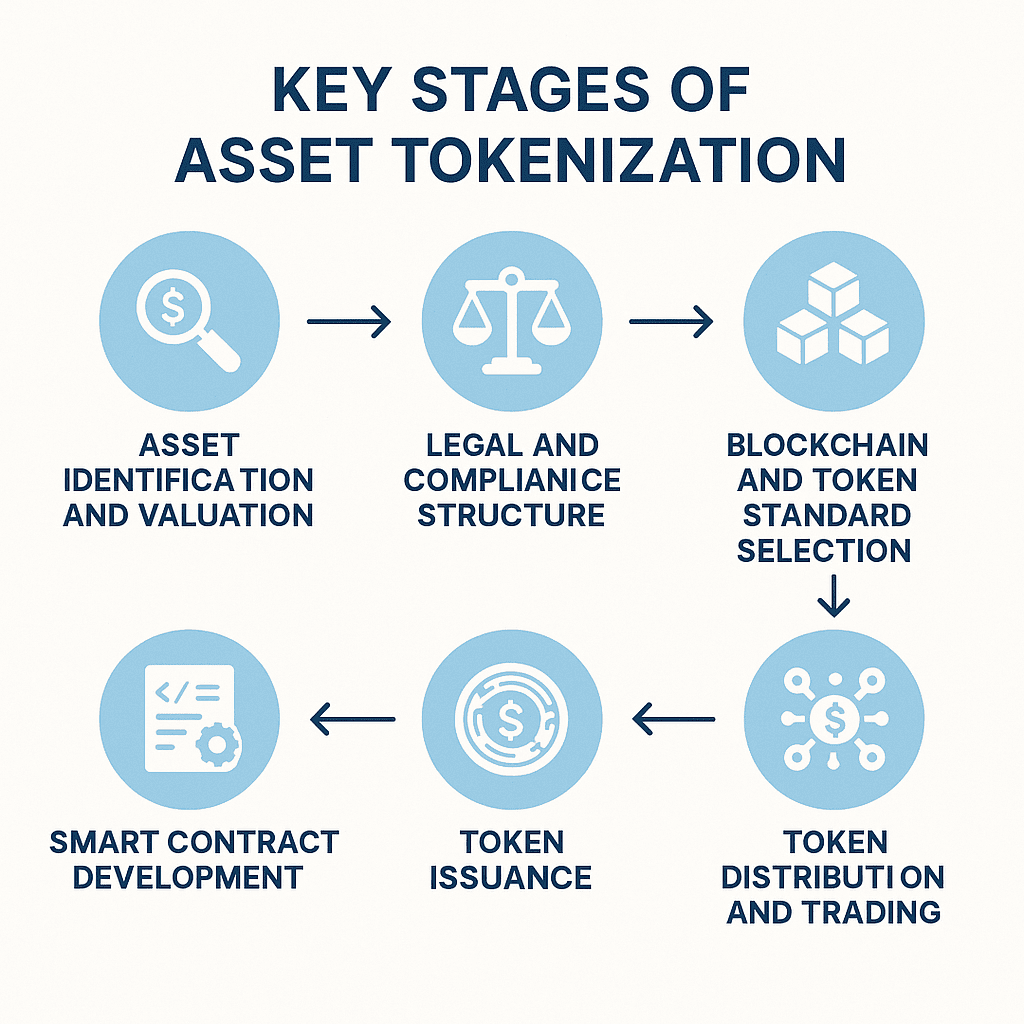

The process of asset tokenization typically involves the following steps:

- Asset Selection and Assessment: Identify the asset to be tokenized and conduct value assessment, ownership verification, and legal due diligence.

- Legal Structure Design: Establish an appropriate legal framework and special purpose vehicle (SPV) to ensure the legal rights of token holders concerning the underlying asset. This may involve trusts, funds, or other legal structures.

- Choosing Blockchain Platform and Token Standards: Select a suitable blockchain network (such as Ethereum, Polygon, Solana) and token standards (such as ERC-20 for fungible tokens, ERC-721 or ERC-1155 for non-fungible tokens, or specialized security token standards).

- Smart Contract Development: Create smart contracts to define the token’s attributes, issuance rules, transaction logic, rights distribution (such as dividends, rental income), and potential governance mechanisms.

- Asset Custody and Connection: Place the real-world asset with a reliable custody institution (if necessary) and establish mechanisms to ensure the on-chain tokens are linked and synchronized with the off-chain asset’s rights.

- Token Issuance and Distribution: Issue and distribute tokens to qualified investors through security token offering (STO) or other compliant methods.

- Secondary Market Trading: Tokens can be traded on compliant exchanges or P2P platforms, providing liquidity.

Role of Smart Contracts in Tokenization

Smart contracts are the core technology of asset tokenization. They can automate the execution of asset-related terms, such as ownership transfers, revenue distributions, and voting rights, reducing manual intervention while improving efficiency and transparency.

Fractional Ownership

Tokenization allows high-value, indivisible assets (like real estate or masterpieces) to be divided into smaller token shares. This enables more small-scale investors to participate, lowering the investment threshold.

5.3 Core Advantages of Asset Tokenization

Learning Objective: Recognize how tokenization enhances asset liquidity and accessibility.

- Increased Asset Liquidity: Traditionally illiquid assets (like real estate, private equity, and artwork) can be tokenized into smaller portions, facilitating easier trading on global secondary markets, significantly improving liquidity.

- Lower Investment Thresholds: Fractional ownership allows smaller investors to invest in high-value assets, broadening the investor base and democratizing investment opportunities.

- 24/7 Trading Availability: Blockchain-based markets can operate continuously, unhindered by traditional exchange hours, enhancing trading flexibility and efficiency.

- Reduced Intermediary Costs and Enhanced Efficiency: Tokenization and smart contracts can automate many manual processes in traditional asset transactions (like clearing, settlement, and ownership registration), reducing reliance on banks, brokers, and lawyers, thus lowering transaction costs and time.

- Increased Transparency and Verifiability: Ownership records and transaction histories are recorded on an immutable blockchain, allowing anyone to (within permission limits) view and verify them, enhancing market transparency and trust.

- Enhanced Composability: Tokenized assets can be more easily integrated into DeFi protocols, creating new financial products and services, such as using tokenized real estate as collateral for loans.

- Expanded Financing Channels: Provides asset owners with new financing avenues, reaching a broader range of global investors.

5.4 Major Application Areas of Asset Tokenization

Learning Objective: Explore specific application cases of tokenization across different asset classes.

- Real Estate Tokenization: Tokenizing commercial real estate, residential properties, hotels, etc., allows investors to purchase partial ownership and share rental income or appreciation.

- Stock and Bond Tokenization (Security Tokens):

- Stocks: Tokenizing company equity facilitates fundraising for startups or the circulation of existing stocks.

- Bonds: For example, the Philippines has promoted the tokenization of government bonds to enhance issuance efficiency and market transparency. Corporate bonds can also be tokenized.

- Art and Collectible Tokenization: Tokenizing masterpieces, antiques, luxury items (like watches) allows investors to co-own high-value collectibles or provide artists with new financing and monetization options.

- Precious Metals and Commodity Tokenization: For instance, tokenizing gold (like PAXG), where each token represents a certain amount of physical gold ownership, facilitating trading and storage.

- Fund Share Tokenization: Tokenizing shares of private equity, venture capital, or hedge funds enhances their liquidity and transferability.

- Intellectual Property Tokenization: Tokenizing music royalties, patent rights, film rights, etc., allows for financing or revenue sharing.

- Carbon Credit Tokenization: Tokenizing carbon emissions allowances or reductions promotes liquidity and transparency in the carbon market.

- Receivables and Supply Chain Finance: Companies can tokenize their receivables for financing, improving cash flow.

- Agricultural Product Collateral Loans: For instance, a Spanish bank collaborates with blockchain to tokenize agricultural products (like corn harvest rights) as collateral for credit, supporting farmers’ funding needs.

- ステーブルコイン Stablecoins themselves are a successful example of RWA tokenization, tokenizing fiat assets like the US dollar and bringing them onto the blockchain.

5.5 Application of Tokenized Assets in DeFi

Learning Objective: Understand how RWAs integrate with decentralized finance (DeFi).

Bringing Real World Assets (RWAs) into decentralized finance (DeFi) is a significant trend in the blockchain industry, aiming to connect traditional financial markets with emerging DeFi ecosystems. The main applications of RWAs in DeFi include:

- RWAs as Collateral for Lending:

- DeFi lending protocols (like MakerDAO, Aave, Compound) are beginning to explore accepting tokenized RWAs (like tokenized real estate, treasury bills, receivables) as collateral to lend stablecoins or other crypto assets.

- This expands the range of acceptable collateral for DeFi protocols, reducing reliance on purely crypto assets and providing new financing channels for RWA holders.

- Yield Products Based on RWAs:

- Creating structured products or yield-bearing tokens based on RWA cash flows (like rent, loan interest) provides DeFi investors with stable income sources that are less correlated with the crypto market.

- For example, bundling tokenized RWAs that generate stable cash flows (like short-term corporate loans) for DeFi users to invest.

- Connecting Traditional Finance with DeFi:

- RWA tokenization helps bring the vast liquidity and asset classes of traditional financial markets into DeFi, offering broader application scenarios and more sustainable growth for DeFi.

- Conversely, DeFi’s efficiency and transparency can also bring innovation to the traditional RWA market.

- RWA-Backed Stablecoins: Besides fiat and crypto assets, RWAs can serve as collateral for stablecoins, providing a more diverse range of stablecoin options.

- Liquidity Pools and Market Making for RWAs: Creating liquidity pools for RWA tokens on DEXs allows users to trade these assets and generate returns for liquidity providers.

However, the application of RWAs in DeFi also faces challenges, such as asset valuation, legal rights, custody, clearing mechanism complexities, and ensuring trustworthy connections between off-chain assets and on-chain tokens.

5.6 Challenges and Risks of Asset Tokenization

Learning Objective: Identify the main legal, regulatory, and technical risks during the tokenization process.

Legal Rights and Ownership Definition Issues:

- Ensuring that on-chain tokens genuinely represent legal ownership or rights to off-chain physical assets is one of the biggest challenges. Different jurisdictions have varying legal provisions regarding this.

- Rights for token holders (such as voting rights, revenue distribution rights, redemption rights) need to be clearly defined and legally protected.

- Particularly for NFT artworks and the ownership of physical assets, legal frameworks remain underdeveloped regarding the treatment of assets in cases of bankruptcy.

Global Regulatory Policy Uncertainty:

- Asset tokenization (especially for securities) is subject to strict regulation under national securities laws and financial regulations. Currently, there is a lack of unified regulatory standards globally.

- Regulatory bodies are still exploring whether tokens constitute securities, how to conduct KYC/AML, and tax treatment. International organizations like FATF and IOSCO attempt to establish guidelines, but implementation varies by country.

- Changes in regulatory policy could significantly impact existing tokenization projects.

Barriers and Inertia of Traditional Financial Systems:

- Traditional financial institutions may be slow to accept new technologies, potentially facing compatibility issues with tokenized assets.

- High compliance costs and established market structures may hinder the promotion of tokenization.

Smart Contract Vulnerabilities and Platform Risks:

- Smart contracts used for issuing and managing tokenized assets may contain programming vulnerabilities that hackers could exploit, leading to asset losses.

- The security of token issuance platforms, exchanges, or custodians is also crucial.

Complexity in Asset Valuation and Pricing:

- Accurately valuing unique RWAs (like artwork or private equity) and forming fair prices in secondary markets can be challenging.

Liquidity Issues:

- Although tokenization aims to improve liquidity, certain tokenized assets may still have limited actual liquidity if market participants are insufficient or token designs are poor.

Transmission of Inherent Risks within the DeFi Ecosystem:

- If RWAs are integrated into DeFi protocols, they may also be affected by inherent risks of DeFi, such as protocol vulnerabilities, hacking attacks, and governance failures.

Operational Complexity and User Education:

- For ordinary investors, understanding and participating in asset tokenization may still present certain barriers.

5.7 Development Trends and Market Prospects of Asset Tokenization

Learning Objective: Understand market forecasts, institutional participation, and future development directions.

Huge Market Potential:

- Although the current RWA tokenization market is still in its early stages (valued at several billion dollars), many research institutions and industry experts predict significant growth potential in the future. For example, Boston Consulting Group (BCG) estimates that by 2030, the tokenized asset market could reach $16 trillion, making it one of the most important growth engines in the blockchain industry.

Active Involvement of Traditional Financial Institutions:

- Numerous Wall Street giants and major financial institutions (like BlackRock, JPMorgan, Citigroup, Goldman Sachs, Franklin Templeton, etc.) have begun actively exploring or participating in RWA tokenization. They may launch tokenized fund products, build RWA trading platforms, or invest in related technology companies to bring traditional financial assets and liquidity onto the blockchain while utilizing blockchain technology to enhance efficiency.

Gradual Improvement of Legal and Regulatory Frameworks:

- With market development and institutional participation, regulatory authorities are accelerating the formulation of clearer legal and regulatory frameworks to regulate the RWA tokenization market, protect investor rights, and promote innovation. While uncertainties remain in the short term, the long-term trend is towards a more clear and friendly regulatory environment.

Continuous Technological Advancements:

- The scalability, security, and interoperability of blockchain technology are continually improving.

- Smart contracts are becoming more powerful and standardized.

- Supporting infrastructures such as oracles, decentralized identity (DID), and privacy protection technologies are also developing, providing better support for RWA tokenization.

Expansion and Deepening of Application Scenarios:

- Future applications of RWA tokenization will gradually extend from current financial assets (like bonds, funds) to a broader range of physical and intangible assets. Additionally, the integration of RWA with DeFi will deepen, giving rise to more innovative financial products and services.

Standardization and Improvement of Interoperability:

- The industry will gradually form more unified token standards, legal agreements, and operational processes to promote interoperability of RWAs across different platforms and jurisdictions.

Role of Web3 Technologies:

- Core Web3 technologies such as programmable money, smart contracts, and DAOs will further drive the diverse applications of asset tokenization in payments, lending, fund management, supply chain finance, and more.

In summary, asset tokenization is seen as a key bridge connecting traditional finance with the digital asset world, poised to reshape the operation of global capital markets. Despite facing challenges, its vast potential and active institutional participation signal a future filled with opportunities.