8. Know Your Transaction (KYT)

8.1 Essence and Definition of KYT Learning Objective: Clearly define the core concepts of “Know Your Transaction” (KYT) and understand its close relationship and key distinctions from “Know Your Customer” (KYC), along with its unique importance in monitoring digital asset transactions and risk prevention. What is KYT? KYT, or “Know Your Transaction,” is a compliance practice and technological solution specifically tailored for the digital asset space, particularly cryptocurrencies. Its core focus is on the continuous, real-time, or near-real-time monitoring, analysis, and risk assessment of transaction behaviors on the blockchain to detect, prevent, and mitigate financial crime risks associated with these transactions, such as money laundering, terrorist financing, fraud, sanctions evasion, […]

7. Know Your Customer (KYC)

7.1 Definition and Importance of KYC Learning Objective: Define KYC and understand its core position in financial compliance. What is KYC? KYC, or “Know Your Customer,” is a regulatory requirement and business practice that mandates financial institutions (such as banks, securities firms, payment institutions) and an increasing number of non-financial sectors (like cryptocurrency exchanges, real estate agents) to identify and verify the identity of customers before establishing a business relationship and throughout its duration, as well as to understand their business activities and risk profiles. Objectives of KYC: Role of KYC in Preventing Financial Crimes: KYC is a cornerstone of the Anti-Money Laundering (AML) and Combating the Financing of Terrorism […]

6. NFT (Non-Fungible Tokens)

6.1 Definition and Characteristics of NFTs Learning Objective: Clearly differentiate between fungible tokens (FT) and non-fungible tokens (NFT), and deeply understand the core characteristics of NFTs, such as uniqueness, indivisibility, and verifiable ownership, along with their foundational implementation (e.g., ERC-721 token standard). Core Differences Between Fungible (FT) and Non-Fungible (NFT) Understanding NFTs begins with grasping the meaning of “non-fungible,” which requires a comparison to “fungible”: Unique Identifiers, Metadata, and Verifiable Ownership of NFTs NFT Implementation Standards on the Blockchain (e.g., ERC-721, ERC-1155) To ensure compatibility and interoperability of NFTs across different wallets, markets, and applications, their creation and trading typically adhere to specific blockchain token standards. The most well-known standards […]

5. Asset Tokenization

5.1 Concept of Asset Tokenization and Real World Assets (RWA) Learning Objective: Define asset tokenization and what Real World Assets (RWA) are. Evolution of Asset Digitization Asset tokenization is a crucial stage in the asset digitization process. Traditionally, asset ownership was recorded on paper documents or centralized databases. The emergence of blockchain technology allows assets to be represented and traded as digital tokens on decentralized networks. Definition and Process of Asset Tokenization Asset tokenization refers to the process of converting tangible or intangible assets of value in the real world (such as real estate, artwork, stocks, bonds, intellectual property, etc.) into digital tokens through blockchain technology. These tokens are issued, […]

4. Stablecoins

4.1 Definition and Role of Stablecoins Learning Objective: Understand the existence and problem-solving role of stablecoins. The Problem of Cryptocurrency Price Volatility Traditional cryptocurrencies (such as Bitcoin and Ethereum) are known for their extreme price volatility. This high volatility makes them difficult to use as a medium for everyday transactions or as a reliable store of value, limiting their applications in mainstream business and finance. Definition and Goals of Stablecoins A stablecoin is a special type of cryptocurrency designed to peg its price to a relatively stable asset or a basket of assets to maintain price stability. The most common pegged assets are fiat currencies (like the US dollar or […]

3. Digital Asset Trading

3.1 Understanding Digital Assets Learning Objective: Clearly define digital assets and understand their primary forms and classifications on the blockchain, as well as their diverse uses. What are Digital Assets? Digital assets are defined as assets that exist in a digital form, can be owned and controlled, and possess economic value. In the context of blockchain, digital assets specifically refer to those created, issued, and managed based on blockchain technology. Their ownership records, transaction histories, and related rules (defined by smart contracts) are securely and transparently recorded on a decentralized blockchain ledger. Classification of Digital Assets (Overview) Digital assets can be classified into various types based on different dimensions: Uses […]

2. Cryptocurrency Wallets

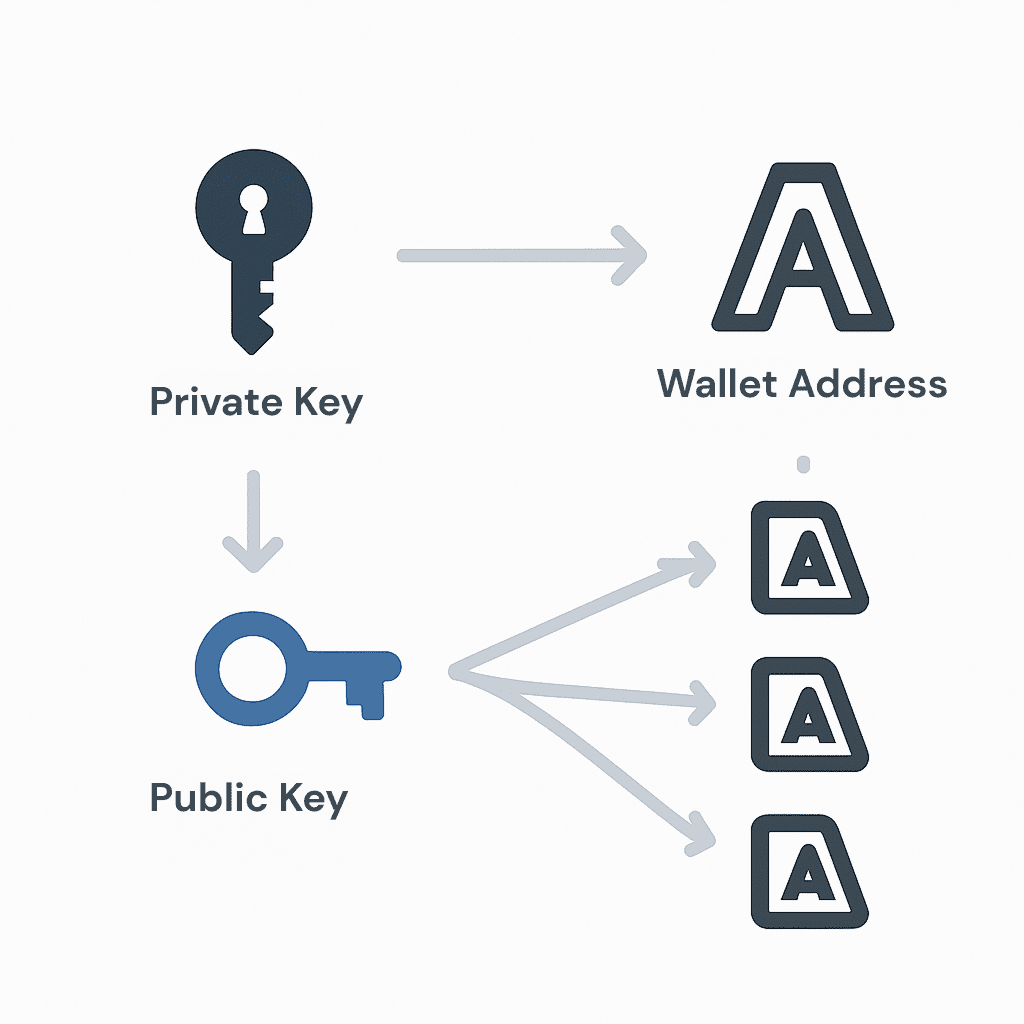

2.1 Basics of Cryptocurrency Wallets Learning Objective: Understand the core functions of cryptocurrency wallets and master key concepts such as public keys, private keys, wallet addresses, and mnemonic phrases, along with their interrelations. Functions and Role of Wallets Cryptocurrency wallets are essential tools for managing and using cryptocurrencies and other digital assets. Unlike traditional wallets, they do not “store” your assets in a physical sense (as digital assets are recorded on the blockchain); instead, they securely store the cryptographic information necessary to access and control these on-chain assets—namely, the private key. Key functions include: Public Key, Private Key, and Wallet Address These are the core components of asymmetric encryption and […]

1. Blockchain Basics

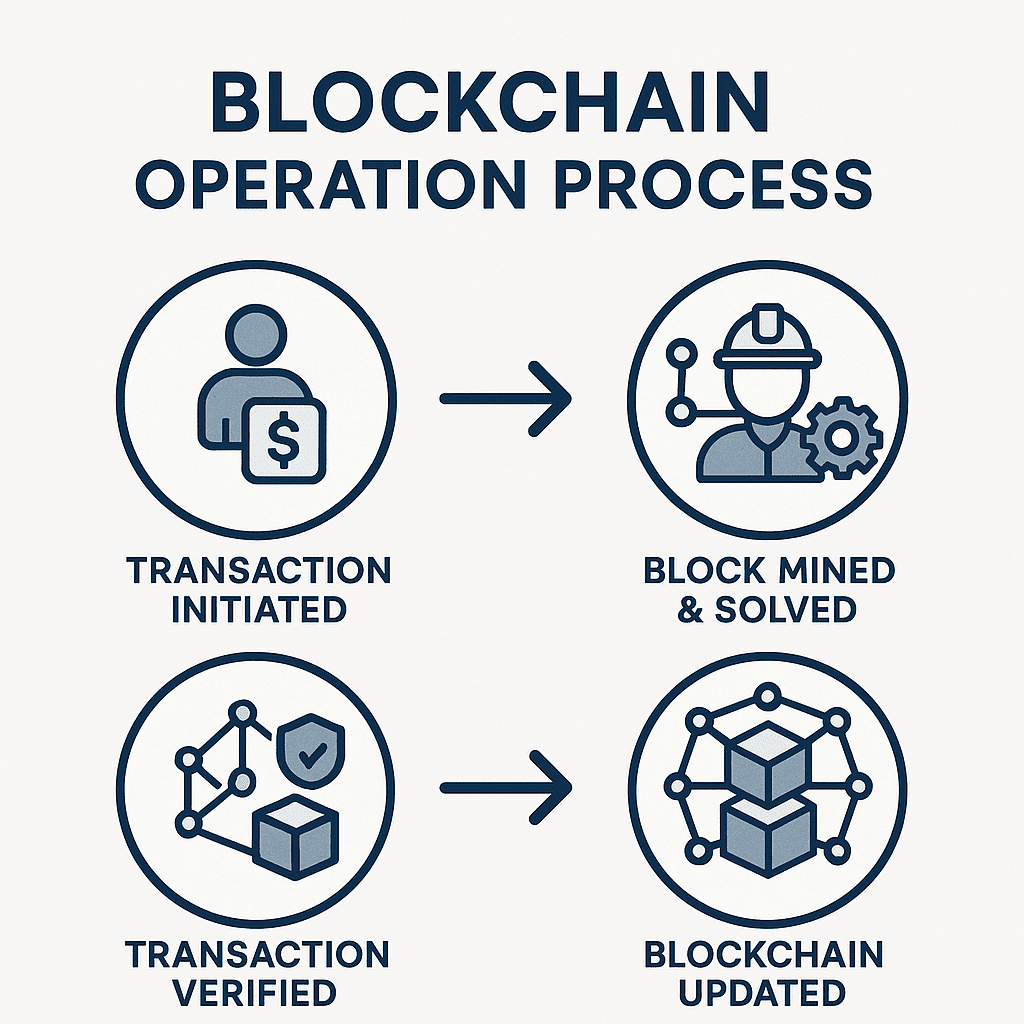

1.1 Definition and Origin of Blockchain Learning Objective: Understand the fundamental definition of blockchain, its historical roots, and its close connection with Bitcoin. Definition: Blockchain is an advanced digital ledger technology that organizes and stores data in units called “blocks” and links these blocks sequentially using cryptographic principles to form a “chain”. This chain creates a distributed, transparent (in public blockchains), and tamper-resistant shared database maintained across multiple computer nodes. Each block records a set of transactions within a specific timeframe and includes a timestamp, ensuring chronological order and traceability. Origin: The concept of blockchain technology can be traced back to 1991, when Stuart Haber and W. Scott Stornetta proposed […]