4.1 穩定幣的定義與作用

學習目標: 瞭解穩定幣的存在和解決問題的作用。

加密貨幣價格波動的問題

傳統加密貨幣(如比特幣和以太坊)以價格極度波動而著稱。這種高波動性使其很難用於日常交易或作為可靠的價值儲存媒介,限制了其在主流商業和金融領域的應用。

穩定幣的定義與目標

穩定幣是一種特殊類型的加密貨幣,旨在將其價格與相對穩定的資產或一籃子資產掛鉤,以維持價格穩定。最常見的掛鉤資產是法定貨幣(如美元或歐元),但也可以包括商品,如黃金,甚至其他加密貨幣。理想情況下,與美元掛鉤的穩定幣的價值應該始終接近 $1。

穩定幣在加密貨幣生態系統中的重要性

- 價值儲存: 在市場波動期間,投資者可將其他加密貨幣轉換為穩定幣,以對沖風險並鎖定價值。

- 交換媒介: 在加密貨幣交易所中通常用作定價和交易對,方便不同加密貨幣之間的交易。

- 付款工具: 由於其價格穩定,更適合日常支付和跨境匯款,可降低匯率風險和交易成本。

- DeFi 的基礎: 它們在分散式金融 (DeFi) 應用中扮演核心角色,例如借貸、流動資金供應和衍生品交易。

- 傳統金融與加密世界的橋樑。

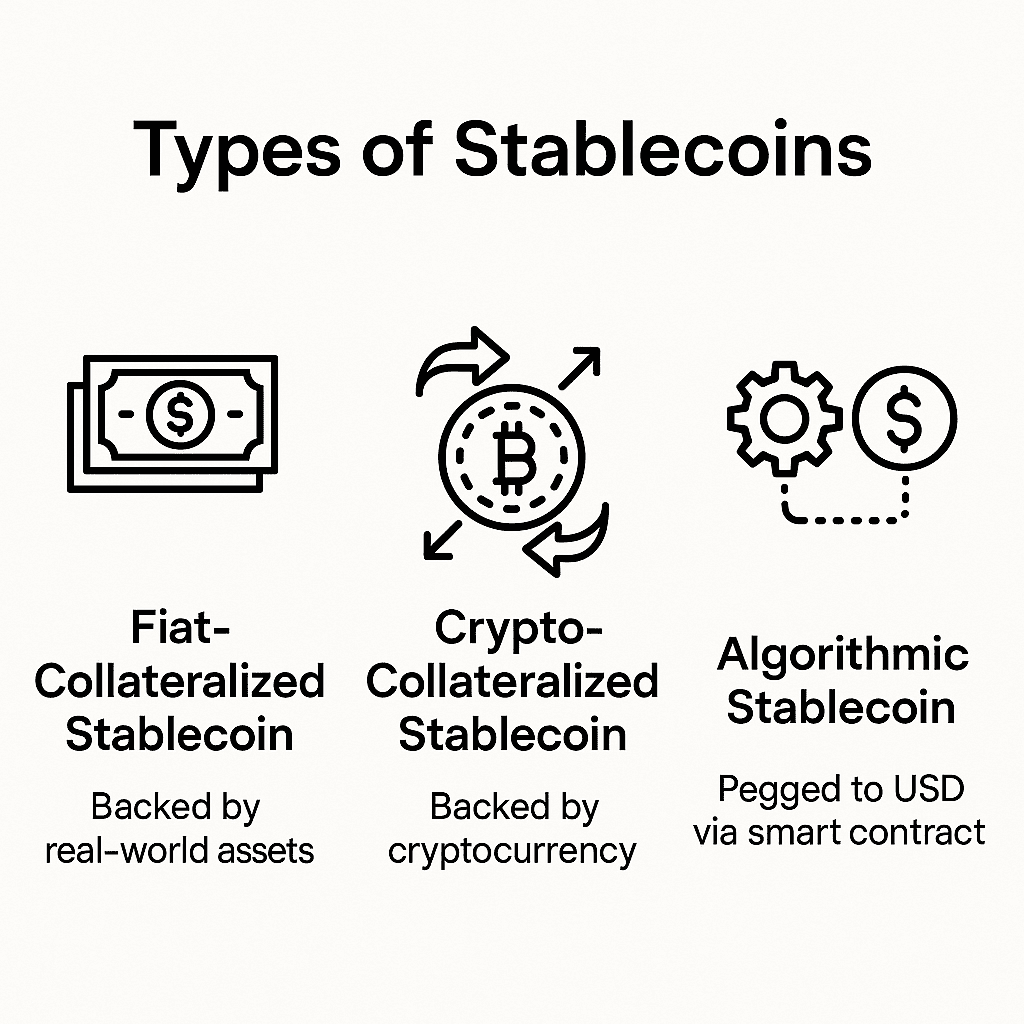

4.2 不同類型的穩定幣

學習目標: 區分並瞭解法定貨幣抵押、加密貨幣抵押和演算法穩定幣的機制。

法定抵押穩定幣

這是最常見的穩定幣類型。發行商聲稱,發行的每個穩定幣都由銀行或其他金融機構儲備的等額法定貨幣(如現金或短期政府債券)支持。理論上,使用者可以 1:1 的比例將穩定幣贖回法定貨幣。

- 範例: USDT (Tether)、USDC (USD Coin)、BUSD (Binance USD,已停止發行新幣)。

- 特性: 相對容易理解,但有賴發行人的透明度以及儲備的真實性和稽核。

加密貨幣抵押穩定幣

這些穩定幣由其他加密貨幣(如 ETH 或 BTC)作為抵押品。由於抵押品的價格波動,它們通常需要「超額抵押」(例如,鎖定價值 $150 的 ETH 來鑄造價值 $100 的穩定幣),以降低抵押品價格下跌的風險。如果抵押品價值低於某個臨界值,可能會被清算。

- 範例: DAI (由 MakerDAO 發行)。

- 特性: 更分散(特別是當抵押品和清算流程由智慧合約自動化時),但機制更複雜,且受抵押資產的波動性影響。

演算法穩定幣

這些穩定幣較少依賴傳統或加密資產作為抵押品,並使用演算法和智慧契約自動調整其供應量,以維持價格穩定。當價格超過掛鉤值時,系統會增加供應量;當價格低於掛鉤值時,系統會回購或燒毀代幣。有些演算法穩定幣可能會使用雙代用幣模式 (一個穩定幣和一個治理或股權代用幣)。

- 範例: (Formerly) UST (TerraUSD)、Ampleforth (AMPL)。

- 特性: 理論上能夠達到高度分散和資本效率,但其設計非常複雜,很容易出現「死亡螺旋」,導致脫耦崩潰(如 UST/LUNA 事件)。

商品抵押穩定幣

這些貨幣與黃金或石油等實物商品掛鉤,發行機構持有相應數量的實物商品作為儲備。

- 範例: PAX Gold (PAXG)、Tether Gold (XAUT)。

混合穩定幣

這些機制結合了上述多種機制,例如部分以法定貨幣抵押,部分以演算法調整。

4.3 穩定幣的機制

學習目標: 深入瞭解不同類型的穩定幣如何維持價格穩定。

Fiat-Collateralized:

- 儲備資產與審計透明度: 發行商(如 Tether 的 USDT、Circle 的 USDC)聲稱每發行一枚穩定幣,就會持有等量的法幣資產作為儲備。為了維持市場信心,發行商通常會定期發佈儲備證明報告或接受第三方審計。使用者可透過市場套利協助穩定價格:當一個穩定幣的價格超過 $1 時,套利者會買入儲備資產,並鑄造新的穩定幣出售;當價格跌破 $1 時,他們會買入穩定幣贖回法定貨幣。

加密貨幣抵押:

- 過度抵押與智慧契約: 以 MakerDAO 的 DAI 為例,用戶可以將 ETH 和其他加密貨幣鎖定在 Maker 協議金庫中,作為借用(鑄造)DAI 的抵押品。為了緩衝抵押品的價格波動,該協定要求超額抵押(例如,最低抵押率為 150%)。如果抵押品價值因市場低迷而接近清算臨界值,用戶必須增加更多抵押品或償還 DAI;否則,抵押品將被智能合約自動清算,以償還債務並穩定 DAI 價值。DAI 的價格穩定也有賴於套利者和治理機制(如調整穩定費用)。

算法穩定幣:

- 供應調節機制: 這些穩定幣試圖透過類似中央銀行公開市場操作的方式來控制貨幣供應。

- 當穩定代幣價格 > 掛鉤價格 (例如 $1):系統增加供應量 (例如:分發新代幣給持有者或降低鑄幣成本),鼓勵銷售以降低價格。

- 當穩定幣價格 < 掛鉤價格 (例如 $1):系統減少供應 (例如:回購並燒毀代幣或增加鑄幣成本/鼓勵燒幣),促使購買抬高價格。

此機制在很大程度上依賴市場參與者的理性行為以及對系統的持續信心,而在壓力測試下,這已經證明是非常脆弱的。

4.4 穩定幣的實際應用

學習目標: 探索穩定幣在各種情況下的具體用途。

- 交易所交易和定價: 穩定幣(尤其是 USDT 和 USDC)是加密貨幣交易所中最常用的交易對之一。許多加密貨幣直接以穩定幣計價,方便交易者計算盈虧和套利。

- 跨境支付和匯款: 與傳統銀行電匯相比,使用穩定幣進行跨境支付可以更快(在幾分鐘內結算)、更便宜(費用更低),而且全天候可用。

- DeFi 生態系統的核心:

- 借貸平台: 使用者可以透過存入穩定幣賺取利息,或使用其他加密貨幣作為抵押來借入穩定幣。

- 流動資金準備: 在分散式交易所 (DEX) 上,穩定幣通常會與其他加密貨幣組成交易對,讓流通量提供者賺取交易費用。

- 產量耕作: 使用者可透過提供穩定幣流動性或參與 DeFi 協定內的攤分,賺取治理代幣等獎勵。

- 衍生工具交易: 許多 DeFi 衍生工具都以穩定幣定價和結算。

- 資產對沖與波動性緩解: 在加密貨幣市場大幅波動期間,投資者可以將其不穩定的加密貨幣轉換為穩定幣,以暫時對沖市場風險,同時等待更好的入市點。

- 薪資支付和商業結算: 越來越多的區塊鏈專案和對加密貨幣友好的企業開始使用穩定幣來支付員工薪水或結算商業夥伴之間的交易。

- 遊戲和 NFT 市場: 穩定幣也常用於購買遊戲內的資產或 NFT。

4.5 穩定幣的風險與挑戰

學習目標: 識別與穩定幣相關的脫耦、儲備管理、監管和智慧合約的潛在風險。

脫離風險

這是穩定幣的核心風險。即使是設計良好的穩定幣,在極端市場條件、儲備金不足、銀行擠提、發行者失去信任或套利機制失效的情況下,也可能偏離其聯繫價值。

- UST/LUNA 案例分析: 2022 年 5 月,演算法穩定幣 TerraUSD (UST) 及其姊妹代幣 LUNA 經歷了死亡螺旋,導致嚴重脫幣並最終崩潰,市值蒸發上千億美元。這次事件暴露了純演算法穩定幣在沒有足夠外部抵押品的情況下的重大漏洞。

儲備透明度與管理風險 (主要針對法定抵押品)

- 發行人是否真正持有充足且優質的儲備資產?

- 儲備的組成是否明確,稽核報告是否可信且頻繁?

- 儲備是否有被凍結或挪用的風險?

- 如果大量使用者同時嘗試贖回,發行人能否以足夠的流動性回應?

法規政策的不確定性

穩定幣的全球監管框架仍在發展中,各國的態度不盡相同。未來可能會推出更嚴格的法規,影響穩定幣的發行、流通和使用。例如,美國證券交易委員會 (SEC) 已對 BUSD 的發行商 Paxos 採取行動,導致新幣停止發行。

智慧契約與演算法瑕疵風險 (主要針對加密貨幣抵押與演算法)

- 智慧型契約可能包含可能被駭客利用的編碼漏洞。

- 演算法模型的設計可能存在缺陷,無法適應所有市場條件或惡意攻擊。

- Oracles (為智慧型契約提供外部資料) 可能會被操控或失敗,導致不正確的價格饋入和清算。

導致凍結的集中化風險 (主要針對法幣抵押)

一些中心化的穩定幣發行商(如 USDT 和 USDC 的發行商)可以根據法律要求凍結特定位址上的資產,這與區塊鏈的去中心化和抵制審查的精神相矛盾。

交易對手風險

即使穩定幣本身設計良好,如果儲存於不安全的交易所或錢包中,仍然會面臨被盜的風險。

資產流動性與合規性

一些新興的穩定幣可能會因為市值較小或地理限制而面臨流動性不足或市場接受度低的問題,使得在不同平台之間自由兌換具有挑戰性。

4.6 穩定幣的近期發展趨勢

學習目標: 瞭解目前穩定幣市場的演變及潛在的未來發展方向。

增強透明度與儲備稽核

在多次市場衝擊和監管審查之後,主流穩定幣發行商(尤其是法幣抵押)越來越注重提高其儲備的透明度,例如更頻繁地發布詳細的儲備組成報告,並接受更嚴格的第三方審計。

中央銀行數位貨幣 (CBDC) 研究與發展

全球許多中央銀行都在積極研究或試行他們的數位貨幣。CBDC 的出現可能會對現有的私人穩定幣市場產生深遠的影響,有可能會造成競爭,並促進整個數位支付生態系統的發展。

逐步釐清法規架構

主要經濟體(如美國、歐盟、英國、新加坡、香港)正加速制定針對穩定幣的法規,涵蓋發行許可證、儲備金要求、消費者保護和反洗錢。這有助於市場的標準化,同時有可能提高合規門檻。

DeFi 生態系統對穩定幣的需求持續增長

儘管市場波動不定,DeFi 協議對可靠且流動性高的穩定幣仍有強大的需求。與此同時,DeFi 領域也在探索更創新的去中心化穩定幣模式,試圖在穩定性、去中心化和資本效率之間取得更好的平衡。

多鏈部署與跨鏈互操作性

主流穩定幣傾向於在多個區塊鏈網絡上發行(例如,USDT 和 USDC 存在於 Ethereum、Tron、Solana 等),以擴大其應用範圍和用戶群。跨鏈橋接和互操作性協定的發展也促進了穩定幣在不同鏈之間更順暢的轉移。

與傳統金融整合

一些穩定幣專案和支付公司(如發行PYUSD的PayPal)正努力將穩定幣整合到傳統支付系統和金融服務中,促進其在真實支付場景中的應用。

重新評估演算法穩定幣

UST 崩潰後,市場對於純演算法穩定幣的信心受到嚴重衝擊。演算法穩定幣的未來設計可能會強調混合抵押品、更健全的風險控制機制或與實體經濟的連結。

總而言之,穩定幣被視為連接傳統金融與數位資產世界的重要橋樑,準備重塑全球資本市場的運作。儘管面臨挑戰,其巨大的潛力和積極的機構參與預示著未來充滿機會。