From Bitcoin to Web3: Understanding the Explosive Evolution of Bitcoin's Ecosystem

The cryptocurrency landscape is witnessing a seismic shift as Bitcoin—once viewed solely as digital gold—transforms into a vibrant foundation for Web3 applications. This evolution is marked by unprecedented growth in Bitcoin's Layer 2 (L2) and sidechain solutions, which have surged to over 25 projects in less than a year. To put this in perspective, Ethereum took three years to develop 48 L2 solutions. This acceleration signals Bitcoin's dramatic expansion beyond a store of value into a programmable ecosystem capable of supporting decentralized applications (dApps), smart contracts, and complex financial instruments.

Categorizing Bitcoin's Expanding Universe

The Bitcoin ecosystem can be systematically divided into distinct categories based on functionality and technological approach:

-

Stacks

Emerging as a significant Bitcoin L2 platform, Stacks achieves SEC compliance and notable decentralization milestones. Its unique Proof-of-Transfer (PoX) consensus enables STX stakers to earn BTC yield—a feature unmatched in the ecosystem. With the imminent Nakamoto upgrade promising 100% Bitcoin finality and sBTC (programmable Bitcoin), Stacks is poised to unlock an estimated $500 billion in latent capital. -

NFTs & Token Standards

Innovations like Ordinals, BRC-20, and the upcoming Runes protocol at Bitcoin's halving are creating new markets. Binance's listing of ORDI (a BRC-20 token) validates this space, while alternatives like BRC-721E and SRC-20 provide miners with crucial fee revenue beyond block rewards. -

Sidechains

Solutions like Rootstock and Liquid Network extend Bitcoin's functionality through EVM-compatible smart contracts and enhanced privacy. These operate with varying degrees of trust in custodians but significantly improve transaction speed and programmability. -

Rollups & Partial L2s

Projects like Urbit and Botanix Spiderchain propose scalability solutions. Urbit integrates a shared identity system for node communication, while Botanix uses a distributed multisig network for a two-way Bitcoin peg. These innovations require Bitcoin Improvement Proposals (BIPs) for full functionality. -

BitVM Computing Paradigm

This groundbreaking approach enables Turing-complete smart contracts without altering Bitcoin's opcodes. Though currently limited, BitVM offers verifiable computation through logic gates and state management across UTXOs—opening new possibilities for Bitcoin programmability. -

Lightning Network

As a payment-focused L2, Lightning combines off-chain computation with on-chain settlement. Despite challenges around trust models, it demonstrates significant growth in enabling fast, affordable Bitcoin transactions. -

Digital Asset Issuance

Protocols like Taproot Assets and RGB facilitate asset issuance directly on Bitcoin. These developments point toward Bitcoin supporting diverse assets including real-world assets (RWAs), expanding its financial utility. -

Ecosystem Integrations

Cross-chain projects like SOLightning (Solana integration) and NomicBTC (Cosmos integration) enhance Bitcoin's connectivity across the blockchain space, increasing its relevance in Web3. -

Data Availability (DA)

Emerging solutions like Nubit and Spice Network address escalating data demands from innovations like Inscriptions, improving scalability and cost-efficiency for Bitcoin-based applications.

Deep Dive: Leading Bitcoin Scaling Projects

Stacks: The Pioneer Bitcoin L2

Core Innovation: Proof-of-Transfer (PoX) Consensus

- Miners transfer BTC to validate transactions and mine STX blocks

- Transferred BTC rewards STX "stackers" who lock tokens to secure the network

- Hybrid model combines PoW-like bidding with PoS-like staking economics

Nakamoto Upgrade (Imminent):

- Sub-10-Second Transactions: Decouples Stacks block production from Bitcoin's 10-minute blocks

- 100% Bitcoin Finality: Inherits Bitcoin's security against chain reorganizations

- sBTC Launch: Enables 1:1 Bitcoin-backed programmable asset via trust-minimized bridge

- Multi-VM Support: Introduction of EVM and Rust-VM subnets solves Clarity language limitations

RGB++: UTXO-Based Scaling Protocol

Architecture:

- Extends RGB protocol by moving computation to Nervos Network's CKB blockchain

- Uses Bitcoin UTXOs with single-use seals and client-side validation

- Leverages RISC-V virtual machine for off-chain execution

Key Advantages:

- No BIP Required: Operates atop Bitcoin's existing infrastructure

- 100% Security Inheritance: Matches Bitcoin's double-spend resistance

- Performance Optimization: "Jumps" transactions from Bitcoin to CKB for efficient processing

- Backward Compatibility: Maintains RGB functionality while enhancing capabilities

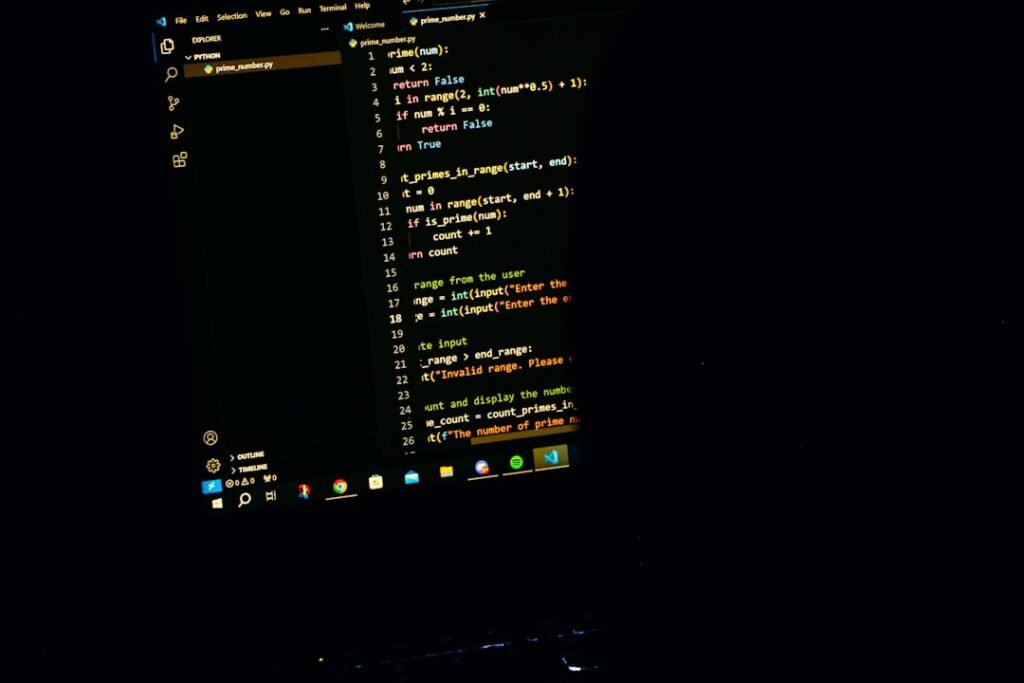

Merlin Chain: EVM-Compatible ZK Rollup

Technical Approach:

- Integrates oracle network, on-chain BTC fraud proofs, and ZK rollups

- Powered by Particle Network's BTC Connect for wallet abstraction

- Supports native Bitcoin assets: BTC, BRC20, BRC420, Atomicals, and Bitmap

Value Proposition:

- Enables Ethereum developers to deploy dApps on Bitcoin infrastructure

- Allows Ethereum users to interact with Bitcoin assets without specialized wallets

- Uses BTC staking to generate yield in Merlin-based assets

BOB (Build on Bitcoin): EVM Rollup Evolution

Development Roadmap:

- Launch as optimistic Ethereum rollup for liquidity bootstrapping

- Integrate Bitcoin security via merged mining (simultaneous BTC/BOB mining)

- Transition to ZK rollup using Risc Zero's STARK-proof RISC-V system

主な特徴

- BOB SDK with BTC light client and MetaMask Snap for Ordinals

- EVM core supporting existing tooling and infrastructure

- Future BTC staking mechanism

BEVM: Bitcoin-Gas EVM Chain

Breakthrough:

- Processes transactions using BTC as gas

- Implements Schnorr signatures for decentralized cross-chain operations

- Requires Bitcoin light nodes on BEVM validators for real-time header sync

Capabilities:

- Full EVM compatibility for Ethereum dApp migration

- Merkle proofs ensure cross-chain data integrity

- Eliminates need for separate gas tokens

B² Network (Bsquared): ZK Rollup for Bitcoin

Technology Stack:

- zkEVM architecture for Turing-complete smart contracts

- Taproot integration for on-chain verification

- BTC Connect integration for native asset compatibility

Scalability Benefits:

- Enhanced privacy through zero-knowledge proofs

- Reduced transaction costs and increased throughput

- Supports DeFi, NFTs, and social applications

Nostr Assets: Social-Focused Asset Protocol

Integration Model:

- Combines Taproot Assets with Nostr's decentralized social networking protocol

- Leverages Lightning Network for instant, low-cost transactions

- Uses Nostr keys for wallet management

Use Cases:

- Social trading of Bitcoin-based assets (stablecoins, NFTs)

- Micropayments integrated into social interactions

- No blockchain requirement (operates via protocol enhancements)

Comparative Analysis of Bitcoin Scaling Solutions

| Project | Category | Core Tech | ステーキング | BIP Required? | BTC Security Inheritance |

|---|---|---|---|---|---|

| Stacks | L2 | PoX Consensus | STX → BTC yield | いいえ | 100% (post-Nakamoto) |

| RGB++ | Sidechain/UTXO L2 | RISC-V VM | CKB locking | いいえ | 100% |

| Merlin | EVM ZK Rollup | BTC fraud proofs | Yes (Merlin assets) | いいえ | High (claimed) |

| BOB | EVM Rollup | Merged mining → ZK | Planned | いいえ | Not specified |

| BEVM | EVM L2 | Schnorr signatures | いいえ | Likely No | Not specified |

| B² Network | EVM ZK Rollup | zkEVM | Possible | いいえ | Not specified |

| Nostr Assets | Asset Protocol | Taproot + Lightning | いいえ | いいえ | Protocol-dependent |

The Future of Bitcoin's Web3 Evolution

Bitcoin's transformation from digital gold to programmable ecosystem represents the most significant evolution in blockchain since Ethereum's smart contract introduction. Several trends are accelerating this shift:

1. Halving-Driven Innovation

The April 2024 halving coincides with key launches like Runes protocol, driving fee market innovation and miner revenue diversification beyond block rewards.

2. Security Inheritance Breakthroughs

Projects achieving true Bitcoin finality (like Stacks Nakamoto) and UTXO-based security (RGB++) solve critical trust barriers for DeFi applications.

3. EVM Dominance

Most new Bitcoin L2s (Merlin, BOB, BEVM, B²) prioritize EVM compatibility, enabling immediate developer onboarding and liquidity migration.

4. ZK Proof Adoption

Zero-knowledge technology is emerging as the preferred scaling approach, with at least three major Bitcoin L2s implementing ZK rollups.

5. Bitcoin as Gas

BEVM's model of using BTC directly for transaction fees could become standard, enhancing Bitcoin's utility beyond store-of-value.

6. Social Financialization

Nostr Assets demonstrates Bitcoin's potential to power decentralized social platforms with integrated financial primitives.

The rapid expansion of Bitcoin's ecosystem—outpacing Ethereum's early L2 growth—signals a fundamental shift. With over 25 projects launched in under a year and $400+ billion in capital awaiting programmability, Bitcoin is positioned not as Ethereum's competitor, but as the foundational settlement layer for Web3's next evolution. As these scaling solutions mature, we'll witness Bitcoin's most profound transformation: from digital gold to the bedrock of decentralized computation.