8.1 Essence and Definition of KYT

학습 목표: Clearly define the core concepts of “Know Your Transaction” (KYT) and understand its close relationship and key distinctions from “Know Your Customer” (KYC), along with its unique importance in monitoring digital asset transactions and risk prevention.

What is KYT?

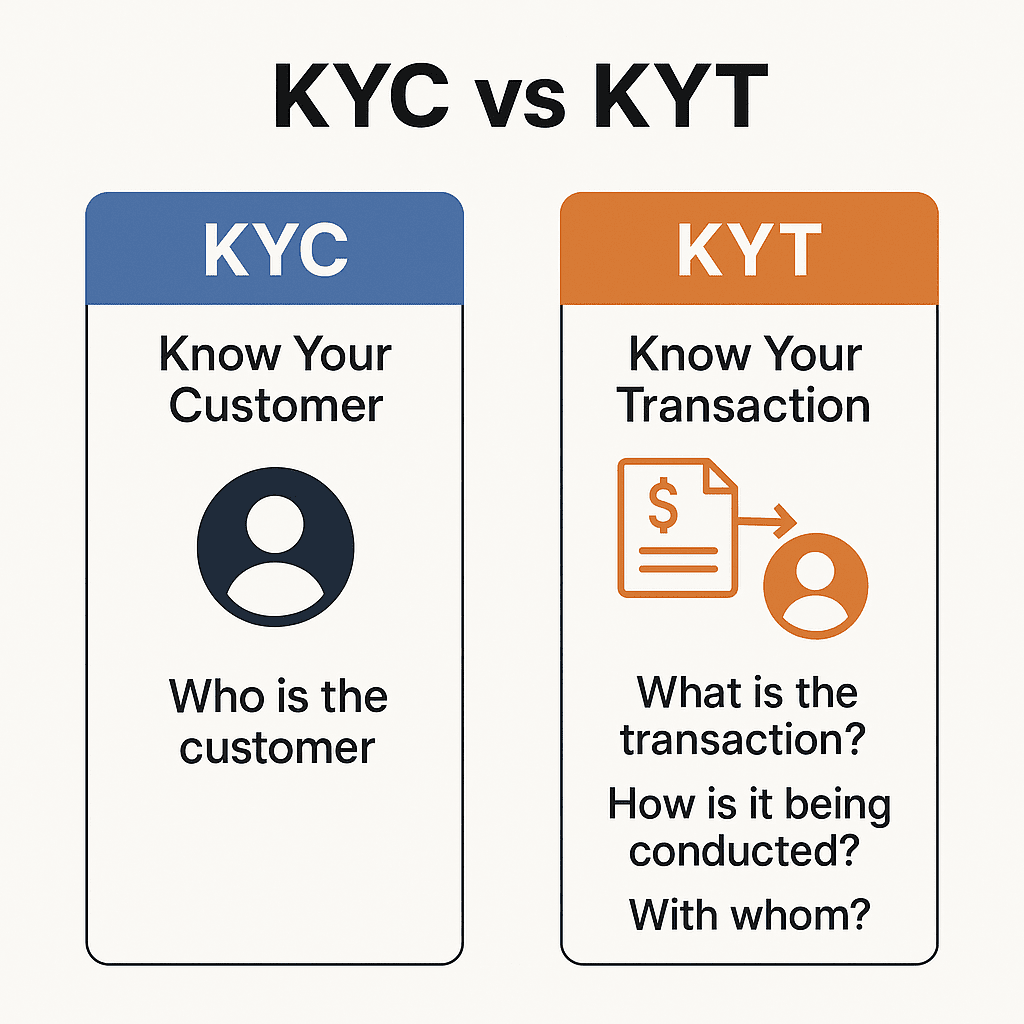

KYT, or “Know Your Transaction,” is a compliance practice and technological solution specifically tailored for the digital asset space, particularly cryptocurrencies. Its core focus is on the continuous, real-time, or near-real-time monitoring, analysis, and risk assessment of transaction behaviors on the blockchain to detect, prevent, and mitigate financial crime risks associated with these transactions, such as money laundering, terrorist financing, fraud, sanctions evasion, and connections to illegal activities like dark web markets or stolen funds. KYT is often seen as a necessary complement and dynamic extension of KYC (Know Your Customer) at the transaction level, together forming a key pillar of the Anti-Money Laundering (AML) and Counter-Terrorism Financing (CFT) compliance framework for Virtual Asset Service Providers (VASPs).

Relationship and Complementarity between KYT and KYC

- KYC (Know Your Customer):

- Focus: Primarily concerned with the static identity attributes of the customer (“Who is the customer?”).

- Core Task: At the onset of establishing a business relationship (onboarding phase) and during periodic reviews, identify and verify the customer’s true identity, understand their background, business nature, source of funds, expected transaction patterns, and conduct initial risk assessments.

- Phase of Action: Primarily occurs before establishing customer relationships and during regular reviews throughout the relationship.

- KYT(거래 정보 확인):

- Focus: Primarily concerned with the dynamic transaction behaviors of the customer (“What is the transaction? How is it being conducted? With whom?”).

- Core Task: During the customer relationship, continuously monitor and analyze each initiated or received digital asset transaction (or those meeting specific conditions) in real-time or near-real-time, assessing the sources and destinations of funds, identifying abnormal transaction patterns, evaluating the risk of counterparties, and detecting involvement with high-risk addresses or behaviors (such as mixing services or connections to the dark web).

- Phase of Action: Primarily occurs during the transaction and post-transaction, involving ongoing dynamic risk monitoring.

Complementary Relationship

KYC provides the foundation for KYT. Understanding who the customer is allows for better judgment regarding whether their transaction behavior aligns with their normal business scope and risk profile. Conversely, the analytical results from KYT (such as detecting frequent transactions with high-risk addresses) can serve as crucial bases for updating customer KYC information and adjusting their risk ratings. Together, they form a holistic and continuous compliance system for customer risk management, spanning from static identity verification to dynamic transaction monitoring and risk management.

Unique Importance of KYT in Digital Asset Transaction Monitoring

Given the characteristics of digital asset transactions, KYT plays a more critical role in compliance and risk control than traditional finance:

- Pseudonymity: Blockchain addresses do not directly expose users’ real identities.

- Global and Instantaneous: Digital assets can be transferred quickly and borderlessly, making tracking and regulation more challenging.

- 탈중앙화: Some transactions may occur in DeFi protocols that lack centralized intermediaries.

- Emerging Money Laundering Techniques: Criminals continually exploit the characteristics of digital assets (such as mixing services, privacy coins, and chain-hopping) to obscure the sources and destinations of illegal funds.

In this context, relying solely on static information collected during KYC at account opening is insufficient. KYT analyzes on-chain transaction data directly, providing deeper and more dynamic insights into the actual flow of funds, identifying addresses and transaction patterns associated with known illegal activities, thus effectively alerting, preventing, and reporting potential financial crimes, helping VASPs fulfill their AML/CFT obligations and protect both their platforms and users.

8.2 Key Concepts and Core Elements of KYT

학습 목표: Deeply understand the core elements and key technical concepts that constitute the KYT system for monitoring, analyzing digital asset transactions, and assessing their risks, such as transaction monitoring dimensions, address risk assessment, anomaly pattern recognition, risk scoring mechanisms, fund flow tracing, and triggering suspicious transaction reports.

Key Concepts and Core Elements of an Effective KYT Solution

An effective KYT solution typically revolves around the following key concepts and core elements:

- Comprehensive Transaction Monitoring: The KYT system continuously monitors and collects data on various dimensions of each digital asset transaction (or those meeting specific filtering criteria). These dimensions typically include:

- Transaction Value: Does it exceed a predefined threshold? Does it align with the customer’s historical trading patterns or claimed financial situation?

- Transaction Frequency: Is the number of transactions unusually high within a specific time frame (e.g., daily or weekly)?

- Transaction Timing: Does it occur during abnormal working hours or sensitive time points?

- Source and Target Addresses: Are these addresses known? Are they on blacklists/sanctions lists? Are they linked to high-risk entities (such as dark web markets, mixers, or stolen fund addresses)?

- Cryptocurrency Type: Is it a privacy coin (e.g., Monero, Zcash)? Is it a high-risk emerging token?

- Transaction Path and Intermediaries: Are funds rapidly routed through multiple intermediary addresses to obscure their true origin? Have they passed through known mixing services or high-risk, poorly regulated exchanges?

- Geographic Information: Are the IP addresses of the sending or receiving parties from high-risk or sanctioned countries/regions? (Although blockchain addresses do not have geographic attributes, VASPs can obtain off-chain information like user login IPs.)

- Address Risk Assessment and Counterparty Due Diligence:

- Address Labeling and Attribution Analysis: The KYT system typically integrates a vast, continuously updated blockchain address database that labels and categorizes known addresses (e.g., those belonging to exchanges, mining pools, DeFi protocols, dark web markets, ransomware, scams, and sanctioned entities).

- Counterparty Risk Screening: When a transaction occurs, the KYT system automatically checks whether the sender and receiver addresses are directly or indirectly linked to these labeled high-risk addresses.

- Address Behavior Analysis: Even if an address is not explicitly labeled as high-risk, the KYT system analyzes its historical transaction behavior patterns (such as transaction frequency, counterparty interactions, and concentration of fund sources) to assess its potential risk.

- Anomalous Transaction Pattern Detection:

- The KYT system utilizes a pre-set business rules engine and/or machine learning algorithms to identify suspicious transaction patterns that deviate from normal user behavior baselines or align with known money laundering/fraud techniques. Common anomalous patterns include:

- Structuring/Smurfing: Breaking down large sums into multiple transactions below reporting thresholds to evade regulation.

- Integration: Aggregating small amounts from multiple unrelated addresses into one address and then executing a large transfer.

- U-Turn/Circular Transactions: Funds passing through a series of complex hops before returning to the original or associated address.

- Rapid Sequential Transactions: Conducting numerous fast transactions with multiple unrelated addresses in a short time.

- Abnormal Interactions with Newly Created or Dormant Addresses.

- Direct or Indirect Transactions with Known High-Risk Services (e.g., unauthorized gambling sites, high-risk mixers).

- The KYT system utilizes a pre-set business rules engine and/or machine learning algorithms to identify suspicious transaction patterns that deviate from normal user behavior baselines or align with known money laundering/fraud techniques. Common anomalous patterns include:

- Dynamic Risk Scoring Mechanism:

- The KYT system conducts real-time, dynamic risk scoring for each transaction or associated customer/address based on a comprehensive analysis of the above dimensions (transaction characteristics, address risk, counterparty risk, transaction patterns, geographic risk, and customer historical behavior). Risk scoring typically results in a quantifiable value or level (e.g., low, medium, high, very high). High-risk transactions trigger alerts requiring further manual review and investigation by compliance teams.

- Funds Tracing and Visualization Analysis:

- Advanced KYT tools (often provided by blockchain analysis companies) can visually trace the complete flow path of digital assets on the blockchain, from the initial source to the final destination, even if funds have undergone multiple transfers or obfuscations. This capability is crucial for investigating suspicious transactions, tracking stolen assets, and understanding complex money laundering networks.

- Suspicious Transaction Reporting (STR/SAR) and Case Management:

- When the KYT system identifies suspicious transactions that reach a certain risk threshold and are confirmed as suspicious after compliance analyst review, VASPs have a legal obligation to submit a suspicious transaction report (STR or SAR) to their local financial intelligence unit (FIU) according to regulatory requirements. The KYT system typically provides case management functionalities to assist compliance teams in documenting investigation processes, collecting evidence, generating reports, and tracking follow-up actions.

The effective integration and collaboration of these core elements form a solid foundation for the KYT system to discover, assess, and respond to financial crime risks related to digital asset transactions.

8.3 Typical Workflow of a KYT System

학습 목표: Systematically understand a typical KYT system’s complete workflow, from data collection to real-time monitoring, anomaly detection, in-depth investigation, risk scoring, and ultimately to alert generation and compliance reporting.

A mature KYT system usually follows a standardized and highly automated workflow to ensure timely, efficient, and accurate management of digital asset transaction risks. This process can be summarized in the following key steps:

- Multi-Source Data Collection and Integration: This is the foundation of the KYT process.

- On-Chain Data: The system retrieves raw transaction data (including transaction hashes, sending/receiving addresses, amounts, timestamps, Gas fees, smart contract invocation information, etc.), block data, and address balances and activity histories directly from one or more public blockchains (such as Bitcoin, Ethereum, and their compatible chains, Solana, TRON) in real-time or near-real-time.

- Off-Chain Data: Integrates customer-related data from the VASP’s own systems, such as:

- Customer KYC information (identity data, risk ratings, business nature, expected transaction patterns).

- Historical transaction records within the platform.

- User login IP addresses, device fingerprints, and geographic information (if consented).

- External Risk Intelligence Feeds: Accesses third-party databases and APIs provided by professional blockchain analysis companies, sanctions list issuers, news aggregation services, etc., to obtain the latest intelligence on known high-risk addresses (e.g., dark web markets, scam addresses, ransomware addresses, sanctioned entity addresses), high-risk entity lists, PEP lists, negative news, etc.

- Real-Time Monitoring, Rule Matching, and Anomaly Detection:

- The core engine of the KYT system continuously scans and analyzes each digital asset transaction flowing into or out of the VASP platform (or occurring between VASP customers).

- Rule Engine: The system screens transactions based on pre-configured business rules (based on regulatory requirements and industry best practices) and risk thresholds. For example:

- Transaction amounts exceeding specific limits (e.g., equivalent to $10,000).

- Counterparty addresses on known blacklists or sanctions lists.

- Transactions involving high-risk geographical areas.

- A large number of small transactions occurring within a short timeframe (suspected structuring).

- Funds originating from or going to known mixing services.

- Machine Learning Models: More advanced KYT systems employ machine learning algorithms (such as supervised learning, unsupervised learning, reinforcement learning) to:

- Learn the normal transaction behavior patterns (baseline) for each customer or address group.

- Automatically identify significant deviations from these normal patterns as anomalous transactions, even if these behaviors do not explicitly trigger preset rules.

- Provide more precise and dynamic risk scoring for transactions and addresses.

- Discover new, unidentified money laundering or fraud techniques.

- Alert Triage, Investigation, and Risk Assessment:

- Alerts generated by the system are automatically prioritized based on severity and confidence levels (e.g., high, medium, low priority).

- Compliance analysts conduct manual reviews and in-depth investigations of these alerts. The investigation process may include:

- Using blockchain explorers and specialized on-chain analysis tools (like Chainalysis Reactor, Elliptic Navigator) to trace the full flow of funds.

- Reviewing detailed information and historical behavior of counterparty addresses.

- Conducting comprehensive analyses combining customer KYC data, historical transaction records, and public information.

- In some cases, directly contacting customers for additional information or explanations.

- Risk Score Confirmation and Disposition Decision:

- Based on the findings from manual investigations and the multi-dimensional risk indicators provided by the system, the compliance team will confirm or adjust the risk level of the transaction or related customer. Based on this, decisions are made on what actions to take, such as:

- Closing the alert (confirming no risk or that the risk is acceptable).

- Requesting further clarification or documentation from the customer.

- Temporarily freezing related accounts or transactions.

- Restricting certain features for the customer (e.g., withdrawals).

- Deciding to submit a suspicious transaction report (STR/SAR).

- In extreme cases, terminating the business relationship with the customer.

- Based on the findings from manual investigations and the multi-dimensional risk indicators provided by the system, the compliance team will confirm or adjust the risk level of the transaction or related customer. Based on this, decisions are made on what actions to take, such as:

- Regulatory Reporting and Filing:

- For transactions or activities confirmed as suspicious, the KYT system usually offers standardized case report templates and tools to assist compliance teams in efficiently preparing STRs/SARs that meet regulatory requirements.

- These reports must be submitted to the relevant financial intelligence units (FIU) or other regulatory authorities within the specified timelines and formats.

- Case Management and Audit Trail:

- The KYT system records all alerts, investigation processes, decision-making bases, actions taken, and submitted reports in detail, creating a complete case file and audit trail. This is crucial for subsequent internal reviews, external audits, and responses to regulatory inquiries.

- Continuous Learning, Model Optimization, and Rulebook Updating:

- The KYT system is not a one-time implementation. VASPs need to:

- Continuously monitor the performance of the KYT system (such as false positive rates, missed detection rates, detection rates).

- Optimize risk assessment models, adjust monitoring rules and thresholds based on the latest money laundering trends, regulatory changes, and lessons learned from real cases.

- Ensure timely updates of external risk intelligence databases.

- Regularly train the compliance team.

- The KYT system is not a one-time implementation. VASPs need to:

This closed-loop workflow ensures that KYT can dynamically adapt to the ever-changing risk environment and effectively support VASPs in fulfilling their compliance obligations.

8.4 KYT Technology Applications and Industry Solution Cases

학습 목표: Gain insight into how KYT systems leverage big data processing, artificial intelligence (AI), machine learning (ML), and graph analysis to achieve efficient transaction monitoring and risk identification, along with an understanding of mainstream KYT solution providers in the market and their practical applications in combating cryptocurrency-related financial crimes.

Key Applications of Big Data Processing, AI, and Machine Learning Algorithms

The core competitive advantage of modern KYT systems lies in their ability to process and analyze vast, high-speed, diverse data, along with algorithmic models that intelligently extract risk signals. Applications of these technologies include:

- Big Data Processing and Storage Architecture:

Blockchain generates millions to tens of millions of transaction records daily, along with related off-chain data and external intelligence, resulting in massive data volumes. KYT systems need to employ distributed computing frameworks (like Spark, Flink), high-performance databases (like NoSQL databases, graph databases), and scalable cloud infrastructures to efficiently collect, clean, store, index, and query this big data in real-time. - Graph Analysis and Network Visualization:

Transactions on the blockchain essentially form a complex network of fund flows (nodes represent addresses, edges represent transactions). KYT systems utilize graph databases (like Neo4j) and graph analysis algorithms (such as pathfinding, community detection, centrality analysis) to visualize and analyze these transaction networks, enabling:- Identification of hidden funding connections, even if funds have undergone multiple hops or obfuscations.

- Discovery of clusters of addresses engaged in collusion (e.g., multiple addresses controlled by a money laundering gang).

- Tracing the final destination of stolen funds or the initial source of illegal funds.

- Deep Application of Machine Learning (ML):

- Anomaly Detection: Using unsupervised learning algorithms (such as clustering analysis, isolation forests, autoencoders) or semi-supervised learning to automatically learn “normal” transaction behavior patterns (baselines) from large transaction datasets and identify significant deviations from these patterns as anomalous transactions, even if these behaviors do not explicitly trigger preset rules.

- Risk Scoring and Predictive Models: Utilizing supervised learning algorithms (like logistic regression, support vector machines, gradient boosting trees, neural networks) based on historical labeled risk cases (such as confirmed money laundering transactions, fraudulent accounts) and multi-dimensional features (transaction amounts, frequencies, counterparty risks, address behavior) to train models that accurately score new transactions or addresses and predict their malicious potential.

- Pattern Recognition and Classification: Training models to recognize known money laundering techniques (such as structuring, U-turn trading, using mixers) or specific types of illegal activities (such as dark web transactions, ransomware payments).

- Natural Language Processing (NLP): Analyzing unstructured textual information related to transactions (such as dark web forum posts, social media discussions, news reports, regulatory documents) to extract key intelligence related to addresses, entities, or risk events, serving as supplementary input for KYT analysis.

- Reinforcement Learning: Exploring methods for dynamically optimizing monitoring strategies and alert thresholds to achieve the best balance between detection rates and false positive rates.

Mainstream KYT Solution Providers (Examples)

Numerous well-known blockchain analysis and compliance technology companies globally provide professional KYT solutions for cryptocurrency exchanges, financial institutions, law enforcement agencies, and regulatory bodies. Major representatives include:

- Chainalysis: One of the market leaders, its KYT (Know Your Transaction) product offers real-time transaction monitoring, risk scoring, address screening, and suspicious activity alerts covering hundreds of mainstream cryptocurrencies and thousands of tokens. Its Reactor product is used for in-depth on-chain investigations and fund tracing.

- Elliptic: Provides similar blockchain analysis and transaction monitoring tools, such as Elliptic Navigator (for risk screening and transaction monitoring), Elliptic Lens (for wallet address analysis), and Elliptic Discovery (for VASP risk assessment).

- CipherTrace (acquired by Mastercard): Offers cryptocurrency intelligence, blockchain analysis, and AML compliance solutions, with its Inspector product used for financial investigations.

- TRM Labs: Focuses on providing blockchain intelligence and risk management platforms for financial institutions and government agencies, assisting in detecting and investigating cryptocurrency-related financial crimes.

- Crystal Blockchain (Bitfury): Provides blockchain analysis and transaction tracking tools supporting AML compliance and law enforcement investigations.

Asian firms mentioned in reference materials, such as ChainUp KYT Solution and Trustformer KYT Solution, indicate that local KYT solution providers are emerging in the Asian market, often combining big data and AI technologies to cater to local market characteristics.

Practical Cases of KYT in Combating Financial Crimes

KYT technology and tools have played key roles in various real-world cases against cryptocurrency money laundering and other financial crimes:

1. U.S. FinCEN Enforcement Actions

The U.S. Financial Crimes Enforcement Network (FinCEN) has repeatedly emphasized that Virtual Asset Service Providers (VASPs) must have effective AML procedures, including transaction monitoring (KYT) to identify and report suspicious activities. VASPs failing to meet these obligations have faced fines in the millions or even billions of dollars. For instance, a 2020 enforcement action against a P2P cryptocurrency exchange operator noted inadequate monitoring and reporting of suspicious transactions.

2. U.S. DOJ Major Case Busts

The U.S. Department of Justice (DOJ) has utilized blockchain analysis and KYT tools to successfully track, seize, and prosecute cases involving billions in cryptocurrency money laundering, including:

- Bitfinex Hack Fund Tracking: Successfully recovering billions of stolen Bitcoin from the 2016 Bitfinex exchange hack.

- Silk Road Market Fund Seizures: Targeting funds associated with the infamous dark web marketplace.

- Ransomware Groups: Tracking funds related to ransomware attacks, such as the DarkSide group in the Colonial Pipeline incident.

3. Exchanges Assisting Law Enforcement

When exchanges or users’ funds are stolen (e.g., via DeFi protocol vulnerabilities or personal wallet hacks), KYT tools are often used to quickly trace the stolen funds on the blockchain, identifying potential entry points into exchanges or other VASPs. Victims and law enforcement can use these leads to request freezing of involved addresses or funds, facilitating asset recovery.

4. Identifying Terror Financing and Sanctioned Entities

KYT tools help identify transactions attempting to finance terrorism or evade international sanctions, providing intelligence support to relevant authorities.

5. Combatting Online Fraud and Investment Scams

KYT tools can analyze the fund transfer paths of various cryptocurrency scams (such as “pig butchering”, Ponzi schemes, and fake ICOs), assisting victims and law enforcement in understanding the flow of funds.

These cases demonstrate the critical value of KYT technology in enhancing transparency in the digital asset space, deterring financial crimes, protecting investors, and supporting regulatory compliance.

8.5 Advantages and Challenges of KYT

Advantages of Implementing KYT Solutions

- Enhanced Transaction Transparency and Financial System Security: Continuous monitoring and deep analysis of blockchain transactions enable VASPs to identify and prevent money laundering, terrorist financing, and fraud, thereby reducing the risk of platform misuse.

- Assisting Compliance with Stricter Regulations: KYT is a core technical means for VASPs to fulfill global and regional AML/CFT regulations, helping avoid substantial fines and reputational damage.

- Protecting User Assets and Platform Reputation: Early detection of abnormal transactions helps VASPs intervene proactively, safeguarding user assets and maintaining trust and reputation.

- Building Customer Trust and Market Confidence: By showcasing robust KYT capabilities, VASPs can demonstrate commitment to security and compliance, attracting more compliant users and institutional investors.

- Promoting Healthy Development of the Cryptocurrency Industry: Effective identification and deterrence of illegal activities help clean the market environment, enhancing the industry’s reputation and credibility.

- Providing Tools and Data Support for Law Enforcement: Data generated by KYT systems aids law enforcement in investigating cryptocurrency-related crimes and supports regulatory risk assessments.

- Improving Operational Efficiency and Reducing Labor Costs: Automated KYT systems can handle vast amounts of transaction data, significantly reducing the workload for compliance teams.

Challenges Facing KYT Implementation

- Challenges of Blockchain Anonymity and Privacy-Enhancing Technologies: While blockchain records are public, participant addresses are often pseudonymous, complicating the identification of real identities. Privacy coins and mixing services further obscure transaction sources and destinations.

- Inconsistent Global Regulatory Standards: Different countries have varying requirements for KYT, complicating compliance for globally operating VASPs. The implementation of the FATF’s “Travel Rule” varies and poses challenges for cross-border enforcement.

- High Technical and Data Integration Requirements: Effective KYT systems require robust capabilities to process and analyze massive transaction data from multiple blockchains alongside off-chain customer data.

- Balancing User Privacy and Data Security: Meeting AML/CFT compliance while protecting user privacy is a sensitive issue that requires careful legal, technical, and ethical consideration.

- High Deployment and Operational Costs: The expenses involved in acquiring advanced KYT systems and hiring compliance analysts can be substantial, particularly for smaller VASPs.

- Balancing False Positives and Negatives: Striking a balance between monitoring rules to avoid missing genuine risk transactions and minimizing false positives that burden manual reviews is critical.

- Evolving Risks and Criminal Methods: Financial criminals continuously adapt to evade detection, necessitating KYT systems and compliance teams to evolve rapidly.

Despite these challenges, advancements in technology, industry experience, and regulatory frameworks will continue to enhance the effectiveness and importance of KYT in digital asset risk management.

8.6 Regulatory Trends and Future Outlook for KYT

Evolving Importance of KYT in the Global AML/CFT Framework

As the digital asset market evolves and integrates more closely with mainstream finance, global regulatory expectations for KYT are continuously evolving. KYT is increasingly viewed as a mandatory core component of VASP compliance operations.

- KYT as a Core Component of AML/CFT Regulations: The Financial Action Task Force (FATF) has established KYT as a requirement for VASPs to implement effective AML/CFT measures, emphasizing ongoing transaction monitoring.

- Emphasis on Continuous Monitoring: Regulatory bodies reiterate the obligation of VASPs to monitor all relevant digital asset transactions continuously, establishing internal policies and systems to detect and report suspicious activities.

- FATF’s Travel Rule Implementation: The Travel Rule, requiring VASPs to collect and exchange identity information for significant virtual asset transfers, enhances transaction risk assessment capabilities in KYT systems.

- Increasingly Detailed Regulatory Requirements: Regulatory expectations for VASP KYT capabilities are becoming more sophisticated, requiring advanced tools and dynamic transaction risk assessments.

- Collaboration Between KYC and KYT: Effective KYC processes are crucial for KYT to accurately assess transaction behavior, indicating a need for a cohesive compliance ecosystem that links static identity verification with dynamic transaction monitoring.

- Focus on Emerging Technologies and Risks: Regulatory attention is growing around DeFi, NFTs, and AI applications in finance, necessitating clearer KYT requirements for these areas.

- Strengthening International Cooperation: Given the cross-border nature of digital assets, enhanced collaboration and information sharing among regulatory bodies and law enforcement is expected.

- Ongoing Innovation in KYT Technology: The future of KYT will see advancements towards more intelligent, automated, and predictive systems, potentially utilizing AI for complex risk assessments while maintaining user privacy.