4.1 Definition and Role of Stablecoins

학습 목표: Understand the existence and problem-solving role of stablecoins.

The Problem of Cryptocurrency Price Volatility

Traditional cryptocurrencies (such as Bitcoin and Ethereum) are known for their extreme price volatility. This high volatility makes them difficult to use as a medium for everyday transactions or as a reliable store of value, limiting their applications in mainstream business and finance.

Definition and Goals of Stablecoins

A stablecoin is a special type of cryptocurrency designed to peg its price to a relatively stable asset or a basket of assets to maintain price stability. The most common pegged assets are fiat currencies (like the US dollar or euro), but they can also include commodities such as gold or even other cryptocurrencies. Ideally, a stablecoin pegged to the US dollar should always be valued close to $1.

Importance of Stablecoins in the Crypto Ecosystem

- 가치 저장소: During market volatility, investors can convert other cryptocurrencies into stablecoins to hedge risks and lock in value.

- Medium of Exchange: Used commonly as a pricing and trading pair on cryptocurrency exchanges, facilitating trading between different cryptocurrencies.

- Payment Tool: Due to their price stability, they are more suitable for daily payments and cross-border remittances, reducing exchange rate risks and transaction costs.

- Foundation of DeFi: They play a core role in decentralized finance (DeFi) applications, such as lending, liquidity provision, and derivatives trading.

- Bridge Between Traditional Finance and the Crypto World.

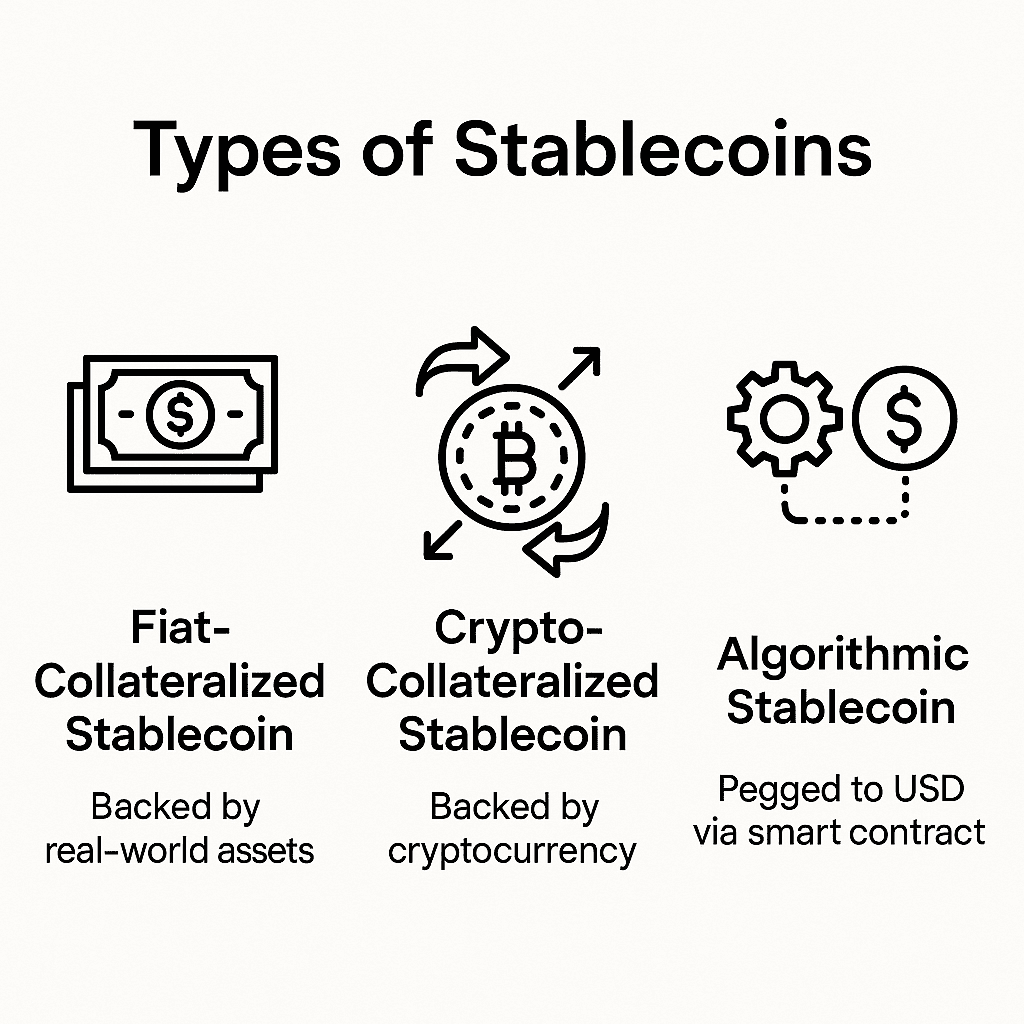

4.2 Different Types of Stablecoins

학습 목표: Differentiate and understand the mechanisms of fiat-collateralized, crypto-collateralized, and algorithmic stablecoins.

Fiat-Collateralized Stablecoins

This is the most common type of stablecoin. Issuers claim that each stablecoin issued is backed by an equivalent amount of fiat currency (such as cash or short-term government bonds) held in reserve at banks or other financial institutions. Users theoretically can redeem stablecoins for fiat currency at a 1:1 ratio.

- 예시: USDT (Tether), USDC (USD Coin), BUSD (Binance USD, which has ceased issuing new coins).

- Characteristics: Relatively easy to understand, but relies on the issuer’s transparency and the authenticity and auditing of the reserves.

Crypto-Collateralized Stablecoins

These stablecoins are backed by other cryptocurrencies (such as ETH or BTC) as collateral. Due to the price volatility of the collateral, they often require “over-collateralization” (for instance, locking up $150 worth of ETH to mint $100 worth of stablecoins) to mitigate the risk of collateral price drops. If the collateral value falls below a certain threshold, it may be liquidated.

- Example: DAI (issued by MakerDAO).

- Characteristics: More decentralized (especially when the collateral and liquidation processes are automated by smart contracts), but the mechanism is more complex and influenced by the volatility of the collateral assets.

Algorithmic Stablecoins

These stablecoins rely less on traditional or crypto assets as collateral and use algorithms and smart contracts to automatically adjust their supply to maintain price stability. When the price exceeds the peg, the system increases the supply; when the price falls below the peg, the system buys back or burns tokens. Some algorithmic stablecoins may use a dual-token model (one stablecoin and one governance or equity token).

- 예시: (Formerly) UST (TerraUSD), Ampleforth (AMPL).

- Characteristics: Theoretically capable of achieving high decentralization and capital efficiency, but they are highly complex in design and can easily experience “death spirals,” leading to decoupling collapses (as seen in the UST/LUNA incident).

Commodity-Collateralized Stablecoins

These are pegged to physical commodities like gold or oil, with the issuer holding corresponding quantities of the physical commodity as reserves.

- 예시: PAX Gold (PAXG), Tether Gold (XAUT).

Hybrid Stablecoins

These combine multiple mechanisms outlined above, such as being partially fiat-collateralized and partially algorithmically adjusted.

4.3 Mechanisms of Stablecoins

학습 목표: Gain an in-depth understanding of how different types of stablecoins maintain price stability.

Fiat-Collateralized:

- Reserve Assets and Audit Transparency: Issuers (like Tether for USDT, Circle for USDC) claim that for each stablecoin issued, an equivalent amount of fiat assets is held in reserves. To maintain market confidence, issuers typically release reserve proof reports regularly or undergo third-party audits. Users can help stabilize prices through market arbitrage: when a stablecoin’s price exceeds $1, arbitrageurs buy reserve assets and mint new stablecoins to sell; when the price drops below $1, they buy stablecoins and redeem them for fiat currency.

Crypto-Collateralized:

- Over-Collateralization and Smart Contracts: Using MakerDAO’s DAI as an example, users can lock ETH and other cryptocurrencies in a Maker protocol vault as collateral to borrow (mint) DAI. To buffer against collateral price volatility, the protocol requires over-collateralization (e.g., a minimum collateralization ratio of 150%). If the collateral value approaches the liquidation threshold due to a market downturn, users must add more collateral or repay DAI; otherwise, the collateral will be automatically liquidated by the smart contract to repay the debt and stabilize DAI’s value. DAI’s price stability also relies on arbitrageurs and governance mechanisms (like adjusting stability fees).

Algorithmic Stablecoins:

- Supply Adjustment Mechanisms: These stablecoins attempt to control currency supply through operations similar to a central bank’s open market operations.

- When the stablecoin price > pegged price (e.g., $1): The system increases supply (e.g., distributing new tokens to holders or lowering minting costs), encouraging sales to bring the price down.

- When the stablecoin price < pegged price (e.g., $1): The system decreases supply (e.g., buying back and burning tokens or increasing minting costs/encouraging burn), prompting purchases to raise the price.

This mechanism heavily relies on rational behavior from market participants and sustained confidence in the system, which has proven to be extremely fragile under stress tests.

4.4 Practical Applications of Stablecoins

학습 목표: Explore the specific uses of stablecoins in various scenarios.

- Exchange Trading and Pricing: Stablecoins (especially USDT and USDC) are among the most commonly used trading pairs on cryptocurrency exchanges. Many cryptocurrencies are directly priced in stablecoins, facilitating traders’ profit and loss calculations and arbitrage.

- Cross-Border Payments and Remittances: Using stablecoins for cross-border payments can be faster (settling within minutes), cheaper (lower fees), and available 24/7 compared to traditional bank wire transfers.

- Core of the DeFi Ecosystem:

- Lending Platforms: Users can earn interest by depositing stablecoins or use other cryptocurrencies as collateral to borrow stablecoins.

- Liquidity Provision: On decentralized exchanges (DEXs), stablecoins often form trading pairs with other cryptocurrencies, allowing liquidity providers to earn trading fees.

- 수확량 농사: Users can earn rewards, such as governance tokens, by providing stablecoin liquidity or participating in staking within DeFi protocols.

- Derivatives Trading: Many DeFi derivatives are priced and settled in stablecoins.

- Asset Hedging and Volatility Mitigation: During periods of significant volatility in the crypto market, investors can convert their volatile cryptocurrencies into stablecoins to temporarily hedge against market risks while waiting for better entry points.

- Salary Payments and Business Settlements: An increasing number of blockchain projects and crypto-friendly businesses are starting to use stablecoins to pay employee salaries or settle transactions among business partners.

- Gaming and NFT Markets: Stablecoins are also commonly used to purchase in-game assets or NFTs.

4.5 Risks and Challenges of Stablecoins

학습 목표: Identify the potential risks of decoupling, reserve management, regulation, and smart contracts associated with stablecoins.

Depegging Risk

This is the core risk of stablecoins. Even well-designed stablecoins may deviate from their pegged value under extreme market conditions, insufficient reserves, bank runs, loss of issuer trust, or failure of arbitrage mechanisms.

- UST/LUNA Case Analysis: In May 2022, the algorithmic stablecoin TerraUSD (UST) and its sister token LUNA experienced a death spiral, leading to severe depegging and eventual collapse, resulting in hundreds of billions of dollars in market value evaporated. This incident exposed the significant vulnerability of purely algorithmic stablecoins without sufficient external collateral.

Reserve Transparency and Management Risks (Primarily for Fiat-Collateralized)

- Does the issuer genuinely hold sufficient and high-quality reserve assets?

- Is the composition of reserves clear, and are audit reports credible and frequent?

- Are reserves at risk of being frozen or misappropriated?

- Can the issuer respond with adequate liquidity if a large number of users attempt to redeem simultaneously?

Regulatory Policy Uncertainty

The global regulatory framework for stablecoins is still developing, with varying attitudes across countries. Stricter regulations may be introduced in the future, affecting the issuance, circulation, and use of stablecoins. For example, the U.S. Securities and Exchange Commission (SEC) has taken action against Paxos, the issuer of BUSD, leading to the halt of new coin issuance.

Smart Contract and Algorithmic Defect Risks (Primarily for Crypto-Collateralized and Algorithmic)

- Smart contracts may contain coding vulnerabilities that could be exploited by hackers.

- The design of algorithmic models may have flaws that cannot accommodate all market conditions or malicious attacks.

- Oracles (which provide external data to smart contracts) may be manipulated or fail, leading to incorrect price feeds and liquidations.

Centralization Risks Leading to Freezing (Primarily for Fiat-Collateralized)

Some centralized stablecoin issuers (like those of USDT and USDC) can freeze assets on specific addresses based on legal requirements, which contradicts the decentralized and censorship-resistant ethos of blockchain.

Counterparty Risks

Even if the stablecoin itself is well-designed, if it is stored on insecure exchanges or wallets, it still faces the risk of theft.

Asset Liquidity and Compliance

Some emerging stablecoins may face issues of insufficient liquidity or low market acceptance due to smaller market capitalizations or geographic restrictions, making it challenging to convert freely across different platforms.

4.6 Recent Development Trends of Stablecoins

학습 목표: Understand the current evolution of the stablecoin market and potential future directions.

Enhanced Transparency and Reserve Auditing

Following multiple market shocks and regulatory scrutiny, mainstream stablecoin issuers (especially fiat-collateralized) are increasingly focused on enhancing the transparency of their reserves, such as publishing detailed reserve composition reports more frequently and undergoing stricter third-party audits.

Central Bank Digital Currencies (CBDCs) Research and Development

Many central banks worldwide are actively researching or piloting their digital currencies. The emergence of CBDCs could have profound impacts on the existing private stablecoin market, potentially creating competition and fostering the development of the entire digital payment ecosystem.

Gradual Clarification of Regulatory Frameworks

Major economies (like the U.S., EU, UK, Singapore, Hong Kong) are accelerating the formulation of regulations targeting stablecoins, covering issuance licenses, reserve requirements, consumer protection, and anti-money laundering. This helps standardize the market while potentially raising compliance thresholds.

Continued Growth in Demand for Stablecoins in the DeFi Ecosystem

Despite market volatility, DeFi protocols still have strong demand for reliable and liquid stablecoins. At the same time, the DeFi space is exploring more innovative decentralized stablecoin models, attempting to achieve a better balance among stability, decentralization, and capital efficiency.

Multi-Chain Deployment and Cross-Chain Interoperability

Mainstream stablecoins tend to issue on multiple blockchain networks (e.g., USDT and USDC exist on Ethereum, Tron, Solana, etc.) to expand their application range and user base. The development of cross-chain bridges and interoperability protocols also facilitates smoother transfers of stablecoins between different chains.

Integration with Traditional Finance

Some stablecoin projects and payment companies (like PayPal issuing PYUSD) are working to integrate stablecoins into traditional payment systems and financial services, promoting their application in real-world payment scenarios.

Reevaluation of Algorithmic Stablecoins

After the collapse of UST, market confidence in purely algorithmic stablecoins has been severely impacted. Future designs for algorithmic stablecoins may emphasize hybrid collateral, more robust risk control mechanisms, or ties to the real economy.

In summary, stablecoins are viewed as a vital bridge connecting traditional finance with the digital asset world, poised to reshape the operation of global capital markets. Despite facing challenges, their vast potential and active institutional participation signal a future filled with opportunities.